Introducing Michelle

Name one thing that we all think about or discuss every single day… money. We carry so many unconscious biases when it comes to looking after our finances. You probably think you’re the exception…

Michelle Hilscher leads the financial services practice at BEworks and, armed with a PhD in cognitive psychology from the University of Toronto, is particularly interested in applying behavioural science to bring about improvements in financial decision-making and financial well-being.

We discuss mental accounting, the importance of skin in the game and the work Michelle’s proudest about. Oh, and we finish with a fun personal money quick fire round!

My partner BEworks

I'm proud to say that I’m publishing ‘A Load of BS: a practitioner's guide to the BS galaxy’ in harness with my partner BEworks, one of the very best behavioural science consultancies in the world, co-founded by Dan Ariely and Nina Mazar.

BEworks is a multidisciplinary team of behavioural scientists and psychologists working on complex challenges across financial services to healthcare to sustainability, helping businesses reimagine a future in which individuals flourish and prosper. If you're interested in what they're up to, you might check out their BEcurious blog or drop Wardah and the team a line at info@BEworks.com.

Take a look at our full line-up of guests here.

Show notes

Connecting the dots between cognitive psychology and financial services

Belief bias

Why is there so much interest in the BS of our finances?

Is the sector ahead of the game?

Pros and cons of mental accounting biases

Windfall spending patterns post-COVID

‘Save More Tomorrow’: keeping people’s savings on track for the long-term

Resolving fraud: putting customers in control

Enforced boundaries and self-regulation

FAFSA: psychological barriers to filling out the US college financial aid application form; neat solutions to improving educational outcomes

Next week on A Load of BS: A Practitioner's Guide to the BS Galaxy

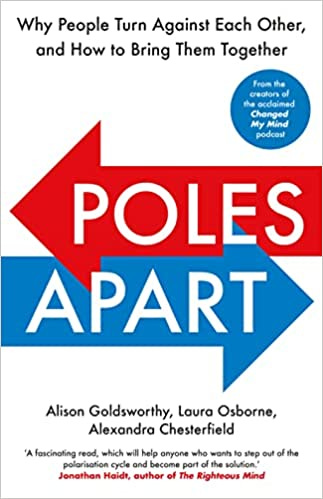

Next week on the show, I welcome Alex Chesterfield, Head of Behavioural Risk at NatWest Group in the UK, where she and her team develop innovative data-led ways to reduce the risk of poor outcomes for the bank, and customers, which result from behavioural root causes.

She is also the author of the highly acclaimed ‘Poles Apart: Why People Turn Against Each Other, and How to Bring Them Together’, clearly a book for our times.

Please share this with friends

If you have an interest in how behavioural science is applied in real life, and you think others would benefit from listening to these conversations, then please share the podcast with friends and on social media. Your support is what makes us tick! Thank you ❤️

Till next time,

Daniel

Share this post