Coming out of the Shadows: FinTech on Paths Less Trodden

The new frontiers for financial access and inclusion

Welcome to all new readers of the Paths Less Trodden interview series. Join other smart, curious folks by subscribing here:

Paths Less Trodden is brought to you by Tshepo, one of South Africa’s most exciting and sought after fashion brands.

Tshepo Mohlala’s story, values and life philosophy are a perfect match for everything that I am striving to show in this newsletter. From the most humble beginnings, Tshepo (meaning hope), the self-taught stylist and designer, has built his business from the ground up, and is recognised as one of South Africa’s hippest denim brands.

He is a born fighter and entrepreneur of the best kind. Follow his rise to international stardom on Twitter and Instagram. Or follow the celebrities and taste makers who love him by checking out the beautiful Presidential Slim Fit jeans here.

Hi friends 😀,

I recently had the pleasure of spending time with Carlos Alonso Torras, lead LATAM investor at venture capital firm FinTech Collective, to discuss his specialist subject – financial inclusion in Latin America. The conversations provoked so many thoughts and ideas, it took me in all different directions, that I’m going to break this post up into two parts. There is still so much to say. In following FinTech Collective’s geographical focus, much of my attention here is on Latin America and Africa, but I try to give some bigger picture perspective as well. There are plenty of embedded links here if you want to dig deeper and I particularly welcome your feedback on markets I don’t address here. Where are the next seeds of activity growing? And what are the next applications of technology that propel the next billion adults into the digital world?

Here is the outline for the discussion. I will publish Part 2 of this on Friday 18th June. Subscribe to ensure it hits your inbox.

Part 1: An explosion of FinTech activity – just the beginning

The FinTech explosion in LATAM

Hot themes

Background to an underserved region

What about Africa?

Cultural sensitivities

Part 2: Emerging Market FinTech futures

My underdog bet in Africa

Where next in LATAM?

Could the future be crypto?

The leapfrog question

Factories of talent

Please enjoy.

Coming out of the Shadows Part 1

I want to be in (Latin) America!

There aren’t many more qualified people to share the secrets of investing in the future of Latin America than Carlos Alonso Torras. He was born in Spain, holds a Brazilian passport and grew up criss-crossing ten cities and five countries, including nearly a decade in Brazil, Argentina and Colombia. His career passport holds box tick business class badges like JP Morgan (FX options trading) and The Wharton School MBA but these foundational privileges quickly propelled Carlos to more meaningful problem solving.

Carlos’s appetite for building financial inclusion was stoked at social enterprise Suyo in Medellin, Colombia where he helped to formalize real property rights for low-income families. Land titling, building registration, legalising a property transaction, ensuring the property you’re buying is free of legal complications or fraudulent activity – formalities implicit in any property transaction for most readers here but just one micro example of how technology is improving lives and reducing bureaucratic friction beyond our sightline.

Since Summer 2019, Carlos has been the lead LATAM investor at FinTech Collective, a New York based venture capital firm whose sector focus is clear. They split attention between developed and developing markets hunting for major secular waves to surf. Beyond Europe and the US, the Collective is most excited by four urban nuclei: Mexico City, Bogota, Sao Paulo and Lagos. Common characteristics make these hubs attractive: (i) large, young, digitally connected populations (ii) transparent and inclusive regulatory systems – Mexico has crafted very pro-FinTech regulation and Colombia is following suit. Since the pandemic, Brazil has been increasingly committed to open banking policies as well as using FinTech to distribute emergency payments (iii) underserved communities and (iv) in LATAM’s case, mainly one common language.

An explosion of FinTech activity - just the beginning

The FinTech revolution in LATAM is no more than a decade old and the increasingly fertile conditions for innovation don’t disguise the huge work still to be done. The first FinTech wave, like Europe and the US, focused on core consumer finance: banking, lending and payments. But already we see a smattering of start-ups moving beyond into savings and investment (Flink, Warren, Gorila), real estate (EmCasa, Houm, LaHaus) and to a lesser extent InsurTech (Alice, Sami, Pier). This has been followed by services targeting businesses, a customer base heavily in need of modernisation in banking (e.g. Oyster – a FinTech Collective investment), payments (e.g. Runa – another FC portfolio member), accounting and employee benefit solutions (e.g. Caju, Flash). And then comes the infrastructure layer, the unsexy enabling technologies unlocking challenges like payments, (e.g. Pomelo, Conekta), fraud (e.g. Truora), Know Your Customer (e.g. Idwall, Mati) and open banking (e.g. Belvo, Swap, Quanto). Thank you to Angela Strange and Matthieu Hafemeister at a16z for proposing these up and coming start-ups from their excellent LATAM FinTech report. Plaid in the US is one of the headline acts in the open banking space, enabling apps like Robinhood, Venmo and Coinbase to access their customers’ bank account information and so helping app users budget, manage expenses and move money around more easily. That open banking now means that any company can be a FinTech (think how Shopify or Uber operate beyond their core service), so the demand for this infrastructure is expanding. Where Direct-to-Consumer FinTech services struggle to cross borders because of local regulation and varied consumer preferences, at an infrastructure level, the architectural utopia of having few global providers who can enable any global internet company to, for example, speedily add bank accounts or issue cards has higher potential but hasn’t been reached yet. Maybe this will play out regionally but there’s no reason why this problem can’t be cracked with patience and experimentation. Payment processing software Stripe is the standard so far.

Having focused mainly on consumer and B2B solutions so far, this ‘under the bonnet’ middle layer is a big FinTech Collective focus now, and particularly fraud. Carlos says: “Mexico and Brazil are the biggest markets in the world for transactional fraud, it’s just absolutely crazy. And sad, but that's the reality. That creates a big business opportunity for companies fighting that.” To amplify the issue, LATAM’s e-commerce growth in 2020 was the biggest globally at 36.7% vs. USA at 31.8%. (source: Shopify)

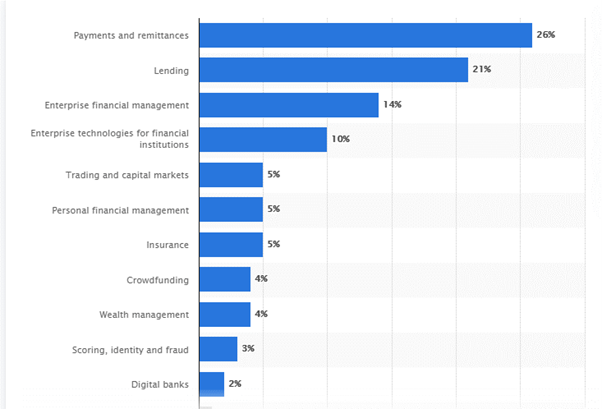

Distribution of fintech start-ups in Latin America in 2020, by business segment

Close to my own heart, insurance is still less touched in LATAM. It has historical low penetration and interest across the continent despite the need. Brazilian InsurTech Pier raised $14.5m last year led by local VC Monashees, but this is one of few. A relative lack of innovation here is down to a chicken and egg problem between investors and insurance carriers. Investors want to see a carrier relationship in place before they commit and carriers want to see investment in place before they offer their license.

Why so underserved?

A key factor driving historical financial exclusion in LATAM has been a concentration of power and assets in a small number of banks. Carlos adds colour: “The banks were so profitable, they didn't need to address the problems, they were still making insane amounts of money without even having to address them. You would see people having to go pay bills physically, like literally, I have to pay my electricity bill. I remember a co-worker one time saying I'm gonna go do it. I’m saying, ‘where are you going – you’re not doing it online?’. She says, ‘no, no, I'm gonna go pay it.’ And this is in 2017.”

Much of the population in LATAM is underserved by banks

Still 80% of assets under management in Brazil reside in the top 5 institutions; this is 69% for Mexico and 77% for Colombia. A consequence is that rates for prime and sub-prime borrowers go up to 300% meaning individuals struggle to construct a credit profile and so lack basic economic mobility.

Hence FinTech Collective’s investments for Fund 1 in 2012 followed the core consumer finance trope of banking, lending, payments. Investments in challenger bank Fondeadora in Mexico, payments infrastructure services like Minka in Colombia, Minu in Mexico and Flutterwave in Nigeria and affordable loans provider Rebel in Brazil express the first wave thesis.

COVID effect

Not surprisingly, COVID has had an intriguing effect on LATAM start-ups in the last year, beyond the obvious positive ‘digital accelerant’ or forcing a business model pivot. Carlos talks about human resources innovation and the very open conversations about team organisation and recruitment: “How should functional teams be working remotely, how decentralised can they be? Because of the amount of money that's coming into the ecosystem, hiring is very, very competitive and poaching is aggressive. If I'm a Mexican start-up, I’m now competing for talent across the continent; operators know that and can charge a premium or the next company is going to call them and pay more. Equally, I can recruit more cheaply beyond my home market.”

Cultural proximity

“You're usually talking to people that are at least from the upper middle class, if not from the very wealthy socio economic circles. So that's a reality.”

As the common language makes recruitment and job mobility more fluid, I was curious to know the value of being a native speaker in the countries in which one invests. Unsurprisingly, English is the lingua franca in most board meetings in LATAM. “Usually, there's a foreign investor involved who prefers English. And it's also the reality of the fact that a lot of these entrepreneurs are foreign educated. You're usually talking to people that are at least from the upper middle class, if not from the very wealthy socio economic circles. So that's a reality.”

There are subtleties beyond this which are often missed however. “When you speak the language, it comes with a certain level of cultural understanding that's even more important than the language itself; understanding how these countries work, the ways of doing business there and handling meetings. When you try to add value to companies beyond being an investor, that's when knowing the language is important. If I try to help our companies with commercial partnerships and I'm talking to different corporate groups in Mexico, I could maybe do it in English, but I think that the level of proximity that you can generate would be diminished. I would also hope that not every employee of a Mexican or Brazilian company speaks English; that would be short-sighted as far as recruitment goes.”

African opportunity

While FinTech Collective has been historically less active in Lagos amongst its urban quartet, digging deeper in Nigeria reveals a fascinating prospect but with ingrained barriers to upward mobility. In a 206m population, many have multiple bank accounts weighed down by punitive charges. Financial infrastructure is weak; there is no formal credit system meaning there are very high upfront commitments to purchase or rent a property (sometimes one has to pay 1-2 years rental upfront), there are no student loans so one can’t attend school without paying full fees upfront, and there is no car finance. To paint the picture more richly, there is no social security system, no coherent way to self-identify and generally very low trust. It’s a cash based economy in which people fight for their own interests and juggle side hustle pursuits, whether market stall or Instagram shop. Flutterwave, eying a US IPO after its recent $170m fundraise valuing the company beyond $1bn, is addressing this by enabling merchants and customers to transact safely and digitally. There are others. In October, US payments company Stripe bought Nigerian FinTech business Paystack for $200m and in late 2019 Visa bought a 20% stake in Nigerian payments company Interswitch, the main platform for the country's business-to-business transactions. Nigeria overtook South Africa as Africa’s largest economy in 2019 and so cannot be ignored.

“What I'm trying to tell you is that when we look at new hubs, we're thinking more about Africa than we're thinking about Latin America.”

Remember, Africa came earlier to this party. Before terms like connectivity, API and smartphone were in common parlance, the original poster child pioneer of inclusive FinTech emerged in East Africa from the telecoms sector when Vodafone and Safaricom launched Mpesa in Kenya in 2007, allowing feature phone users to send and store money via phone. This initiative alone has brought financial stability to ¾ of Kenyan adults. Other African territories are catching up at different speeds. Ghana, Rwanda and South Africa are increasingly on investors’ radar; then there is Egypt, straddling Africa and the Middle East, with a 100m+ population (1/4 of the whole Middle East), 60% of whom are under 30 and with overall internet penetration of 70%. They have highly skilled developers and support structures growing. Carlos builds the story: “Cairo is a very interesting market, as a hub in Africa, but also serving the MENA region. We see there what we've seen and are seeing in Mexico. In many investor conversations that we have, they keep mentioning Cairo. Nairobi also has further room for growth as a hub for East Africa. For South Africa, there is Cape Town. But the African market in general is less developed. 1 billion people in Sub Saharan Africa and it's just a matter of time - there's a lot of the same conditions that we've seen in Latin America that will play out in Africa. What I'm trying to tell you is that when we look at new hubs, we're thinking more about Africa than we're thinking about Latin America.”

Concluding for now

Trite but true, the world is changing fast and the ‘I want it now’ Uberisation of customer expectations means that the large, old institutions can no longer rest on their laurels, whether in LATAM, Lagos or London. FinTechs are coming, offering more accessible, affordable and specialist products and services. It may have taken years to understand, but Bill Gates’s statement in 1994 that “banking is necessary, but banks are not” seems more prescient than ever.